Monthly Trading Analysis- May 2025

Calender Performance May 2025

In the month of May, I ended up red 6.78R net.

5 Green Days, 5 Red Days.

I took a total of 55 Day Trades.

Stats:

33% win rate

Average Winner: 1.61R

Average Loser: 0.88R

Sharpe Ratio: 1.88

Risk Management

Out of the 55 trades, with a set risk of 10USD. Only 8 trades exceeded 10 dollar risk, but under 11 dollars. which in my opinion is within tolerance.

I will give myself positive feedback for not taking any day trades with high risk.

33% win rate

Average Winner: 1.61R

Average Loser: 0.88R

Sharpe Ratio: 1.88

Performance by Setup:

My 5min Buy Setups have the highest win rate of 46% with 13 sample points, and my 2min buy setups are 24 % win rate which are hurting the most. Between these two setups, these accounted for 67% of the 55 trades taken in the month.

Performance by Entry Pattern Quality:

I went back over the 55 trades and analyzed the quality of the pattern I would take for a buy setup or sell setup, and ranked them on A+,A,B or “Not Playbook Setup” pattern if lower quality.

6 point criteria:

Daily chart bias inline (stage 2 for buy setup or stage 4 for sell setup) with trade bias timeframe (+1 pt).

60 min chart inline (stage 2 for buy setup or stage 4 for sell setup) with trade bias timeframe (+1 pt)

20EMA on trade timeframe rising or falling according to buysetup or sell setup respectively (+1 pt)

Price above or below 20EMA in trade timeframe according to buy setup or sell setup respectively (+1 pt)

Is price in a stage 2 ( for buy setup) or stage 4 (for a sell setup) in the trade timeframe? ( + 1 pt)

is there a minimum 2 bar pullback in the timeframe of entry ? (+ 1 pt).

If we have 6/6 criteria met, then we have an A+ pattern and we should look to enter.

If we have 5/6 criteria met, then we have an A pattern, and we should look to enter.

if we have 4/6 criteria met, then we have a B pattern, and we should enter the trade with caution.

If we score below 4, then we must wait for additional criteria to meet the 6 point system or look for another ticker.

Just taking into account my A+, A, and B trades, I would have ended the month break even at -0.3R net with 38.63% win rate, 1.67R avg winner, 0.93R average loser, on 44 trades.

If I just took into account my A+ and A trades, I would have ended the month up 3.27R net positive, with 40.62% win rate, 1.76R avg winner, 0.90R avg loser on 32 trades.

This reinforces me to look for the quality A+ and A trades as a first filter.

Once i find a good pattern, then I need to look to enter and manage the position as per plan.

Performance by Time of Day:

Without any trade pattern quality filter, my morning trades were the worst performers. The opening trades lost me the most R, and best profit is made in the afternoon session.

I have the following theories, in the morning session, trends are not necessarily established yet, we are still in the opening drives where stocks whip one way or another, and from there pick a direction ( right side of the V) whether to the long side or short side.

If I filter to see only my A+, A, and B pattern trades, this further shows that my best trades are at least 1 hour after the open.

Taking no trades between 930 and 10, and focusing only on A+,A, and B trades my stats would have been the following:

Net R: 5.47, 46.87% win rate, 1.61R avg. winner, 0.95R avg loser.

If I would have eliminated B trade quality patterns, and not traded the open between 9:30 and 10:00 am,

Net R: 10.08R, 54.54% win rate, 1.75R avg. winner, 0.92R avg. loser.

This week i noticed that trades would trend later in the day, and it was easier to find an entry with a tighter stop. The majority of my trades at the open are losses.

The open is too whippy. risk is wide. and I have made many mistakes.

For June I will only take A+, and A trades, and avoid the first 30 min, to allow the market to settle down.

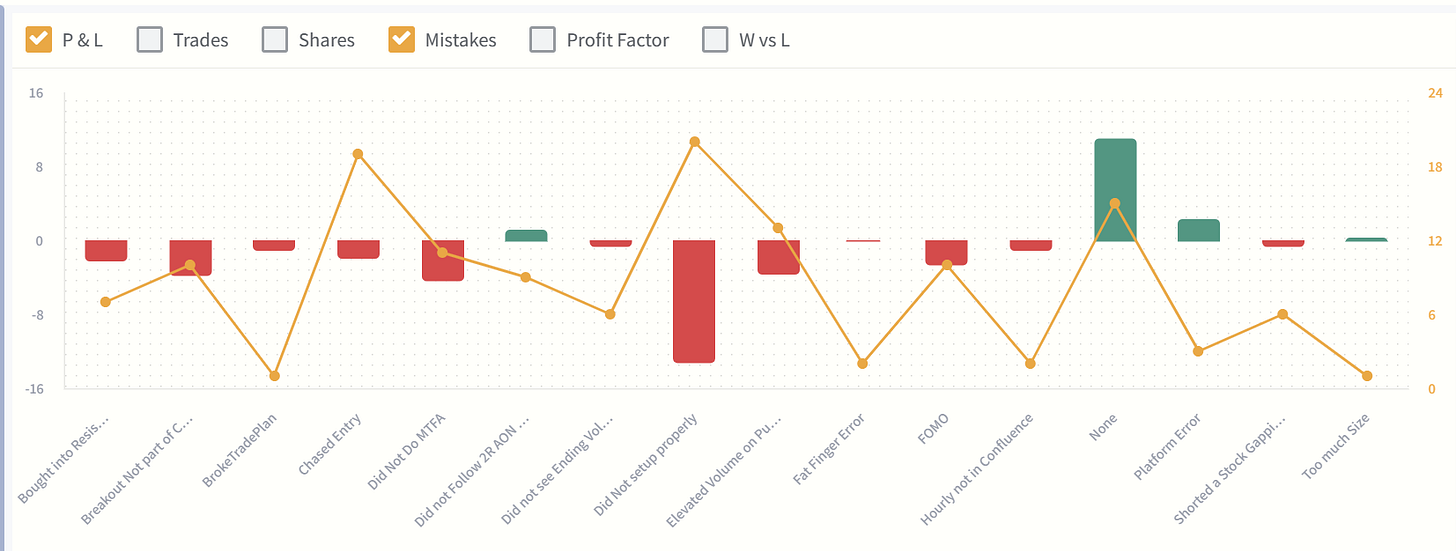

Mistake Analysis:

With respect to mistakes, Chasing and not letting trades setup properly, were the ones most identified. For chasing, i have implemented a hotkey, that will let me place a stop entry order, which will prevent me from chasing.

To help with the did not set up properly mistake, i developed a tool that will allow me to analyze the pattern in under 15 seconds, and give me a score of A+,A,B, or Not Playbook setup.

Going into next week, lets focus on quality trades meeting all checklist requirements with my new tool. Look for that “one good trade” as Mike Bellafiore writes in his book.

What I did well this week:

On the bright side, knowing myself. I had no large losers this month. All entries were with defined risk hotkeys. Proud of myself.

Alternate Trade Strategies:

Comparing 1R AON, 2R AON, 3R AON , Sell 1/2 at 1R, bring SL to BE, and sell rest at 2R, and my actual Strategy:

On week 22, there was no edge in any strategy.

For overall may, 1R AON lost 10R on 40.7% win rate, while 2R AON went just about breakeven at -1.3R, while i was at -4.5R trying to emulate 2R AON. This means, i broke my plan in a couple of trades,also worth mentioning that my strat is using net R, and not gross R, while the alternate strats are using gross R basis.

3R AOn, -2.7R , and 25.9% win rate, and Sell 1-2 at 1R, B/E, and sell rest at 2R, was also negative at -4R, and 40.7% win rate.

Ther was no edge this month.

If i analyze the data above based on pattern quality, and sum up the R values per setup type and method, i get the following table below:

The table indicates, that A+ patterns, and A Patterns are profitable for 2RAON, 3R AON, Sell 1/2 at 1R, B-E, and sell rest at 2R, and my actual trading.

This further suggests that I need to stick to A+ and A patterns only,

Action Plan for June:

Modify Playbook to only trade A+ and A trades according to new tool to be used in real time prior to entering trade. Will Avoid B trades and below.

Modify Playbook to avoid the first 30 min of the open. This means, I will have to do my premarket work earlier, and then make my way to the office, and take the trades in the office.

Action items from Mid May Review

Modify Trade Playbook to include trading with multiple time frame confluence.

Done: new setup tool takes into account multiple time frame analysis.

Modify Trade Playbook to use stop entry orders, and not buying the ask and risking previous candle low to prevent chasing stocks.

Done.

Modify Trade Playbook to allow me to bail out immediately if I knowingly enter a trade with a mistake in real time. This will save me a potential -1R loss.

Done.

Modify Trade Playbook to allow me to raise stop loss at 3:48 pm ( 2 min before market imbalance data is released, to allow me to protect profits, if I am taking a trade in the power hour session.

Done.