Feb 13-2025- DRC

Today was a green day overall…

Weekend Analysis

Looking at this day in hindsight over the weekend. I can see the following observations:

Avg. Loser: 18.36

Avg. Winner: 29.52

Sharpe ratio: 1.6

Batting Average: 53.3%

Based on Avg. Loser as Risk: Gross P/L : 5.86 R

Paid 1.7R in commissions:

Net R: 4.16 R

This is a good day. in my opinion.

Avg. MAE was 13.23, and avg. MFE was 28.88.

Majority of my earnings came from the higher priced stocks.

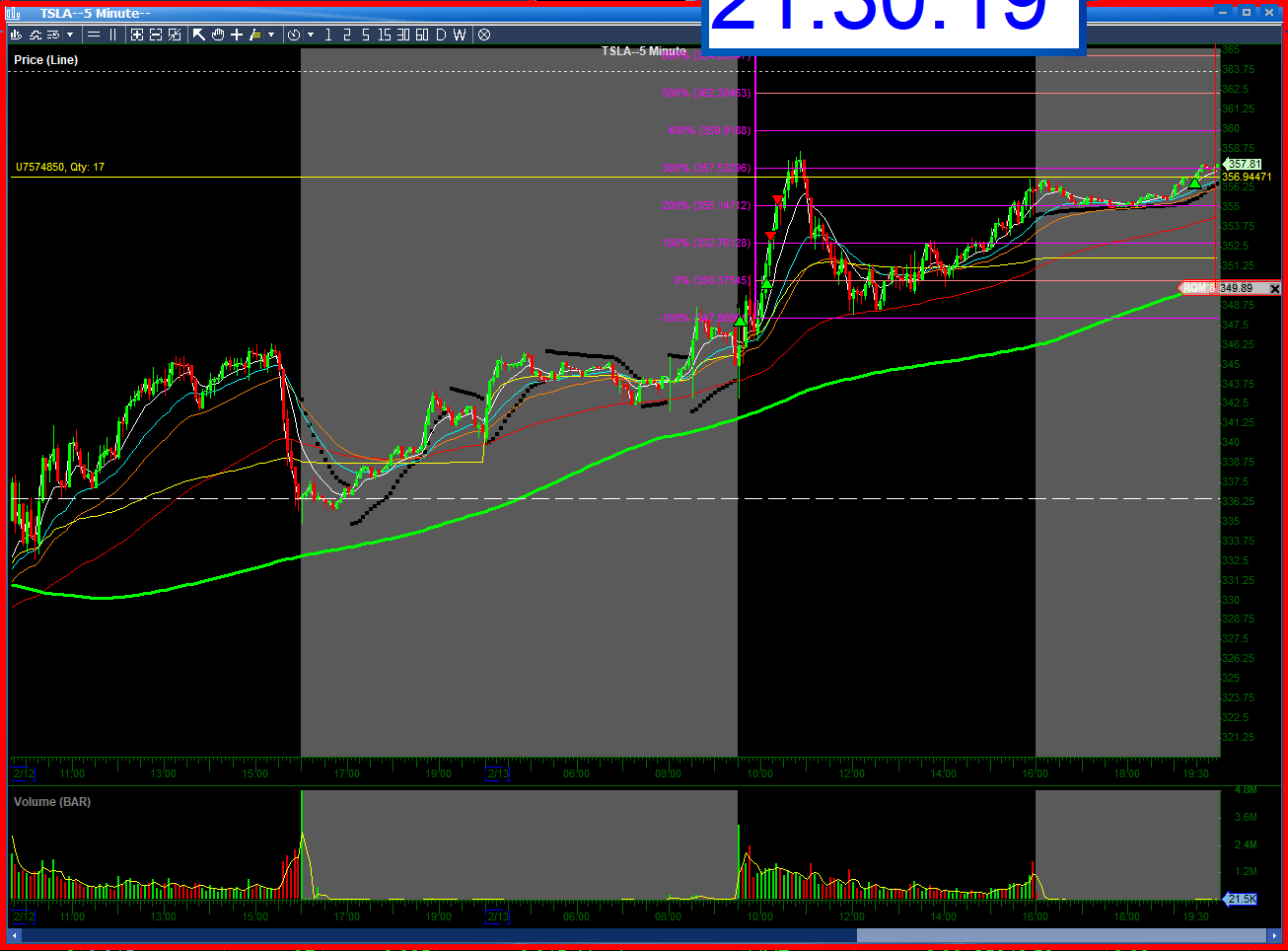

TSLA

Took a double entry, at first i risked LOD, but took send entry, with 2 targets… good trade. recognized the breakout, and added to position. risking previous candle low. good trade. also took a after hours swing risking 200 ema on 5min chart. risking about 100 dollars on the swing.

NVDA

NVDA had a good breakout of DTL on daily, breaking above 200EMA on 5min chart, took long, at first got tapped out, so i i should have probably risked 200 ema on 5 min. or even risk 200 ema since we turned positive above 200ema on 5min.Still happy with trade.

RDDT

This trade was a gap down reversal from yesterdays earnings report. When it recovered the 55EMA on 5 min, i went long premarket, and hit profit target. easly money trade with minimal drawdown.

SPY

Also, bought the SPY breakout of DTL, and had a good move up.

SERV

This trrade at the open was also a good trade, bought the breakout above 20, and break of DTL. Nice bull flag on daily.

AMD

AMD was a sign of buying a breakout,and once hit 1R, moved stop to break even, and the 2nd partial broke even. Good move.

QQQ

QQQ was also a good breakout over previous high of day. bought the horizontal breakout and had a good partialon 1st R, and missed 2nd R, so cut it out early, if i would have followed my rules, this would have broken even.

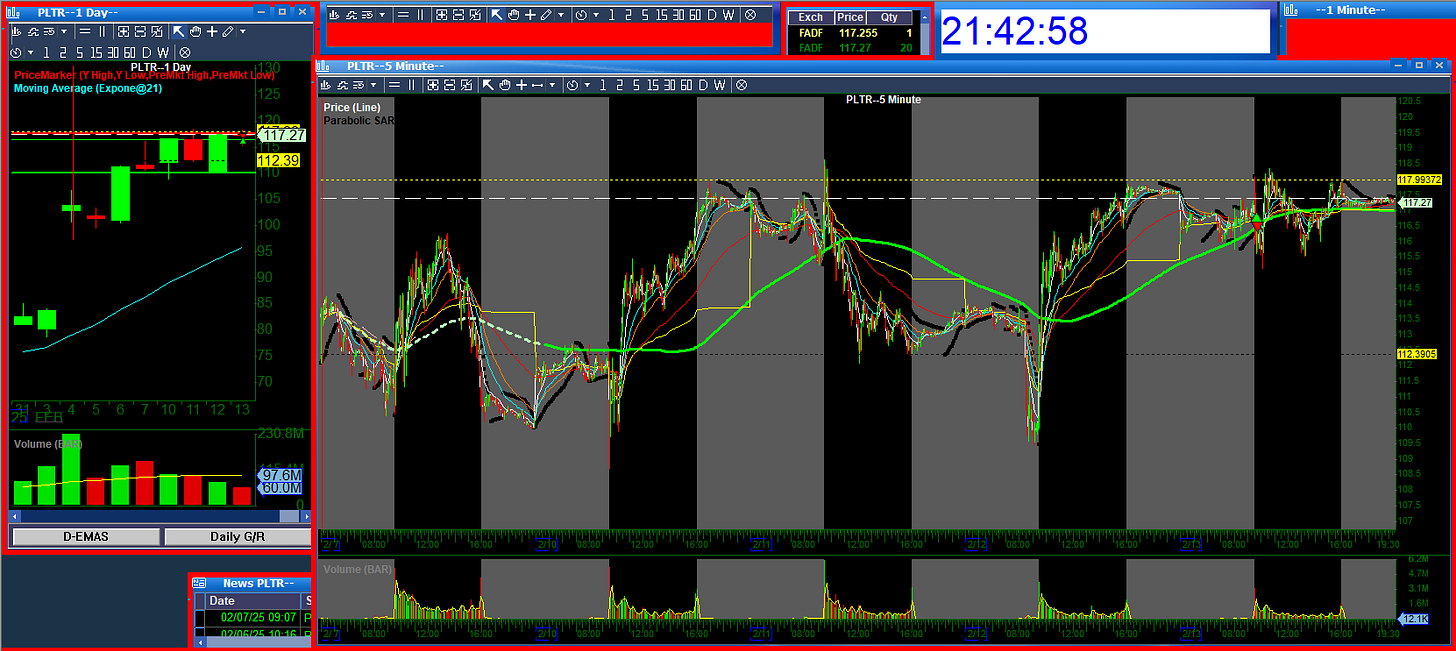

PLTR

This was a bad trade, it was an inside candle at the time, and there was no proper move from inside candle.

SMCI

This was an inside move, there was no breakout on daily, I should have plaed maybe earlier at the bounce off support, and not so much in the middle of the move….. i was too zoomed in.

PRPH

I bought fomo top, if i were had been up earlier, i could have probably caught the earlier breakout. impulse trade.

EDSA

The premarket play was well placed, and the post market play was a swing overnight, but it crapped before the close.

DOMH

This premarket trade was cut out earlier, i had risked low of day in premarket 7.37 level, with profit target 10.7.. but cut it early manually, and it ran up, stupid to not follow my trade plan .. keep o my stops and my profit targets. trade was flat.