GOAL: I am going to be Consistent.

Reminders:

Rely on the new tool to select and filter out the best patterns.

Dont Chase. I have been chasing. will adjust hotkey to prevent chasing.

Remember, stop, if daily stop -3R. Adjust plan, three strikes and I’m out.

New tool will help me with the higher timeframe bias determination.

Previous Day Health Check:

Sleep Quality: 56%, 4 h 8 m, Heart Rate Range: 64-79 bpm. not great.

Ate Healthy? yes, per diet plan.

Exercised Night Before? Yes. walked 6km day before.

What I Learned/Improved upon Today:

I sucessfully used the new tool.

Used it for the day trades. I will need to clearly define in my rules what does it mean to be in a stage. is it the price action, or is it the trendline in the given time frame. Today my eye leaned on the 20EMA slope and if price was above or below it to call it as a given stage. will review further below in each trade.

What did I do well today?

Today, I waited 30 minutes before taking the first trade. Let the market shake itself out and pick a potential direction. This was a new addition to my plan.Good.

I used the tool to filter out patterns. Good. This will allow me to be consistent in qualifying tickers. Its not haphazardly as i was doing before. Strict 6 pt system.

Daily Trade Summary

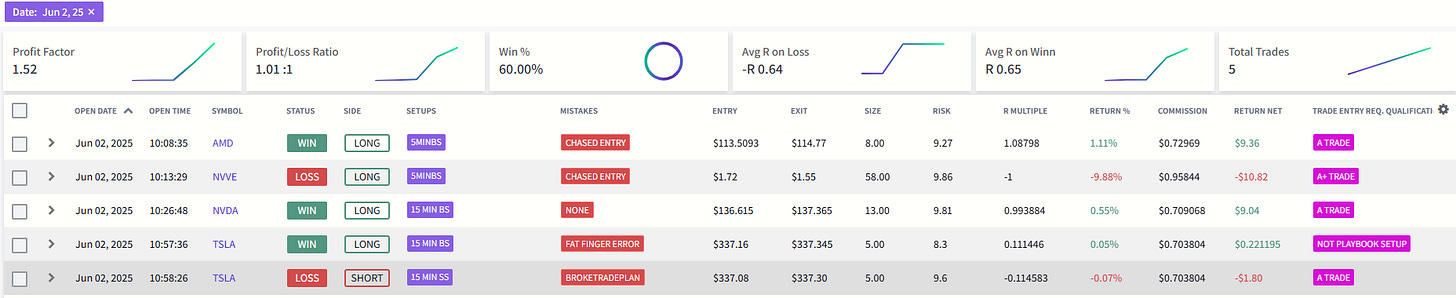

Daily Results: 5 Trades, 4 tickers

Win Rate: 60 %

Gross R: 1.07 R

NET R: 0.67R

Avg: Winner net: +0.65R ( had a small scratch + trade that skewed my average winner TSLA)

Avg: Loser Net: —0.64R

Sharpe Ratio: 1.01

Daily Setup Analysis

Daily Mistake Analysis

Daily Trade Summary

Trade 1: AMD

Mistake: Chased Entry.

TRADE 2: NVVE

Mistake: Chased Entry.

TRADE 3: NVDA

Mistake: None

TRADE 4 & 5: TSLA

This was a scratch trade. I wanted to go short at first, and my tool indicated that this was a A trade pattern, but at first i fat fingered the long button, and went long, i quickly realized the mistake, and then i closed the long position, and went short.

But then i felt wrong going short, because at that moment, the QQQ was going red to green, and above vwap, and above 200ema, and above 20ema. if market stays strong, going red on tsla without a catalyst is not a good idea. I quickly closed my position again, and stayed flat on TSLA. Another sign that made me skittish was the double bottom doji the 2min chart had near 335 level.

Mistake: Fat Finger, Broke Trade plan by not following through 2R AON once in the trade short.

Did I Follow my Trading Plan? (16/ 26) 61.5% Grade.

Trading Objective ( 1 / 3 correct on meeting objective)

Did I trade A and A+ patterns only? No, I fat fingered a long position on what was supposed to be a short (TSLA).

Did I modify Stop losses or PTs once set in( goal is to not modify)? Yes, i scratched out of TSLA trades.

Did I use the new tool for all tickers traded? Yes.

Time Frame ( 4/ 4 correct on time frame)

Did I avoid the first 30 minutes of the market open? Yes

Did I only trade regular session, and not trade premarket? Yes

Did I use MTFA to enter trades? Yes

Did I trade on Monday through Friday ? Yes

Asset Classes Traded (1/1 correct on asset classes)

Did i trade only equities? Yes

Stock Selection ( 3/7 correct on stock selection procedure)

Did I determine market bias in my trades? Yes, QQQ

Did I review what economic indicators were scheduled for the open? No, did not note these down.

Did I run my gap scanner in the morning? Yes

Did I determine which gaps were novice and which were professional? No

Did I rank gaps as L1,L2, L3 to the long and short side per rules? No

Did I only enter trades on Gap list, and not deviate from gap list? No

Did I avoid inside day trades? yes

Risk Managment / Accout Position Sizing (5/5 correct)

Did I risk my stipulated R in plan? Yes

Did I hit max daily draw down? No

Did I hit daily target or 2R or 4R and stop? Did not hit target.

Did I use the new tool to evaluate setups? Yes

Did I enter with predefined risk hot keys? yes

Trade Exit Rules ( 2/2 correct)

If I knowingly made a mistake, did I bail out? Yes

For the correct trades, did I hit 2R AOn or closed at end of day? Yes

Trade Analysis (2/2 correct)

Did I log my trades today in Tradersync? Yes

Did I review for mistakes ,and rule violations? Yes

Trade Management (3/3 correct)

Did i have more than 1R risk open at any time? Yes ( NVDA, NVVE and AMD were open at the same time, did not move stop to break even on one or two of them to enter the other trade). Had 3R risk open potential.

Did I cap my trades at 5 today? Yes

Did I give back more than 1R if I reached my max R profit?No, did not reach max profit target, therefore i did not give back 1R back. NVDA was nearly at 2R target, but was able to recover 1R at end of session close.